Holistic Financial Planning

What it is and why we (don’t) do it

By Abbey Smith

The Women in Ranching (WinR) Circle 2 gathering at TomKat Ranch in April 2019 brought together amazing women from across the western United States in a way that surfaced deep, truthful conversations in a supportive environment. It was here, with these incredible leaders in ranching that Andrea Malmberg and I realized that we are not collectively having open, honest, constructive and useful conversations about money and finances.

As holistic managers and Holistic Management educators, Andrea and I understand the importance of financial planning. But why aren’t we doing it in our own lives? What is blocking us from engaging with this powerful practice and having meaningful conversation about it with our support network and friends? We set out on a journey to find out.

What is Holistic Financial Planning?

Holistic Financial Planning offers a specific approach by which to invest the right time, resources and money in the right enterprises to create the outcomes desired by the decision-makers of the Whole Under Management. To fully understand, step-by-step, how to use the planning procedure of Holistic Financial Planning usually takes three days with the guidance of a Holistic Management educator. After the initial training, the yearly financial planning and frequent monitoring is straight-forward, easy to do, and can lead to increased peace of mind.

The planning procedure has many steps, but the guiding concepts are simple. According to Holistic Management: A New Framework for Decision Making, 2nd Edition, by Allan Savory and Jody Butterfield, Holistic Financial Planning is different than the more conventional approach to budgeting because it is guided by a Holistic Context created by the decision-makers, and accounts for human nature.

To this I would add: it is unique in that it plans for profit first. This is a novel concept in ranching and farming operations. Most farmers and ranchers do not pay themselves and it is often hard for them to imagine a profit to set aside. But it is possible—and can often be the “make it or break it” difference for an agricultural enterprise.

According to a 2017 article in Western Producer, Holistic Management educator Roland Kroos said that we need to plan for profit first and develop the discipline to follow through with our plans. It is human nature to spend all the money we save.

Why is it important?

For the holistic manager, the holistic financial plan is a key operating tool. The annual holistic financial plan is connected to the long-term land plan of the property—or “Whole Under Management.” If the possibility of investing in wealth-generating expenses exists, these expenses will be identified in the long-term land plan and budgeted in the Holistic Financial Plan.

For example, the Holistic Context my husband and I share states that we deeply value self-reliance and self-sufficiency. Our long-term land plan for the ranch we live on and manage is to have the electricity needs of the ranch and home generated by a hydroelectric system powered by springs on the ranch. A wealth-generating expense we may choose to invest in would be the development of the hydroelectric system on the ranch. The combination of the land plan and the financial plan help keep actions and investments in alignment with the Holistic Context. It is so easy on a ranch or farm to invest in reaction to problems. And there is never a shortage of reactionary investments.

Another aspect of Holistic Financial Planning that I really appreciate is the gross profit analysis. This is a process of comparing the gross revenue of each enterprise on the ranch, farm, or other enterprise and seeing which ones contribute the most to the overhead of the whole operation. This can be a painful exercise, especially with “pet” enterprises, like that small flock of sheep or chickens, for example, that mom loves and therefore turns a blind eye to when evaluating the expenses of keeping them against the profit they generate. With potentially sensitive issues such as this one, it may be advisable to engage a professional facilitator to help guide the ranch or farm family through the conversation.

Despite the challenges along the way, the peace of mind that results from aligning financial investments with a Holistic Context may be the most compelling aspect of the Holistic Financial Planning approach. It is so gratifying to know that each dollar spent takes us a step closer to the world we want to live in.

Why do we (not) do our financial planning and monitoring?

With all these powerful qualities, why don’t more people (including myself) create better habits around financial planning? There are two parts to managing finances holistically—the first is to create the financial plan, the second is to monitor the plan, and if needed re-plan.

My husband and I are really good at actually creating the plan. We do this in the week between Christmas and New Year’s. It is a magical season, full of festiveness, hope and possibility. We start our cold winter mornings with coffee, tea and our dreams for the year. It is actually a lot of fun.

Then life sets in. I am traveling internationally with our children as the Savory Global Network Coordinator. He is up and down the state of California teaching Holistic Management courses and setting up Ecological Outcomes Verification monitoring transects. We are lucky to have one weekend together a month, let alone (the perceived) time to go through the process of monitoring our Holistic Financial Plan.

I call this the August Experience. Let me explain. We always make big plans for our land and family in the dreamy winter months. When the days are short, when we have time to play cribbage and read stories by the woodstove. As the year progresses with its challenges and surprises, we keep the dreams and plans alive. Some come to fruition, and for others there is still hope.

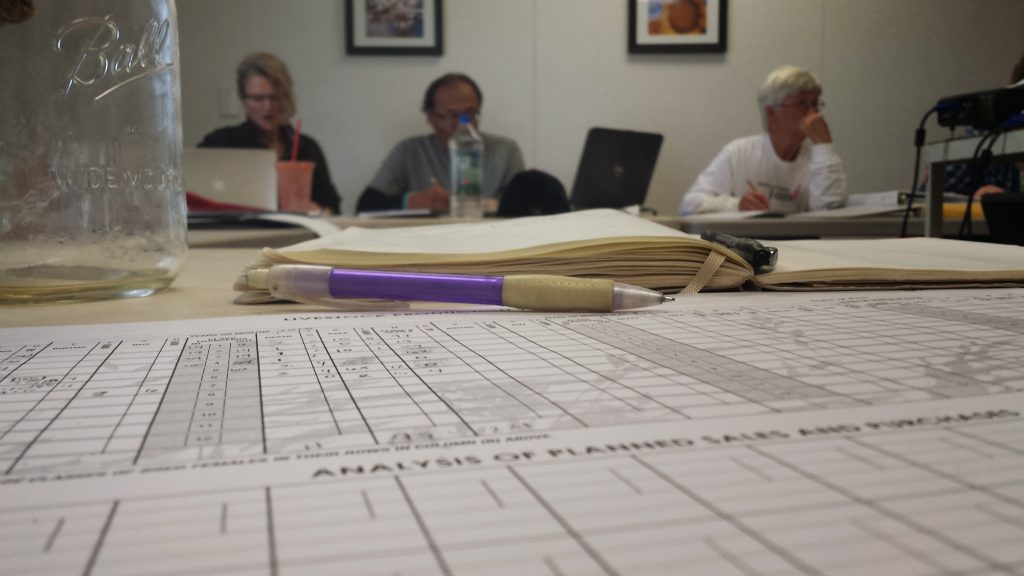

Until August. That is the month when whatever was to be for the growing season, is—or isn’t. It is the month of truth. Sometimes it is deeply rewarding and satisfying, sometimes it is painful. I started to realize that the feeling we get in August happens on a micro level each month when we line up our planned versus actual expenses and income when monitoring our financial plan. Perhaps this stark reality check is what keeps us from rushing to the big Holistic Financial Plan sheet taped on my office wall when we have a free moment.

In a meeting with our fellow holistic managers in California and Oregon recently, we realized we were not alone. We all were not monitoring our plans! What’s the deal? We committed to the group that we would really analyze our situation in the coming month and report back.

My husband and I identified two main factors preventing us from doing our monthly monitoring. First, we needed to simplify (roll up) the enterprises we were tracking, as the level of detail was not helping us make decisions—it was simply bogging us down. The second was time blocking and sticking to it. Knowing that it takes us one hour to get through the process sounds more doable than this unknown, daunting task. After being way behind in June, we are now caught up. The added benefit of taking these steps is that we are reconciled in all our accounts each month, prior to doing our Holistic Financial Planning monitoring. It is a wonderful, peaceful feeling to glance over at that sheet on the wall and now see it up-to-date.

Paying it forward

Now that we had learned this about ourselves, it was time to share with others. On November 7th, Andrea Malmberg and I hosted a webinar focused on this question:

What blocks us from doing the work of making a financial plan, monitoring it and then re-planning as needed?

Andrea’s background in positive psychology helped us gain a deeper understanding: a lot of it is tied to our relationship with and perception of money. More of it is how we value our own life energy. Our life energy is us; it is our most valuable asset. As farmers and ranchers, we may be wonderful managers of land and livestock, but we often do not manage our own life energy well. The current state of social and psychological well-being of farmers across the world is a clear indicator of this fact.

Almost 70 people registered for the webinar and 21 gathered for an hour to dig into this topic with us. This was a clear indicator that we need to talk about money and finances more so that we can better utilize these tools to create the life we want to live. This webinar, we realized, was only the beginning of the conversation and the journey.

We encouraged everyone on the webinar to start getting clear on the relationship they have with money by first becoming aware of its current state, including any blocks, fear-based and negative thought patterns, or deeply-held beliefs they have about their ability to generate and manage money. Then, we asked everyone to spend time reflecting on and crafting the vision of the life they want, together with the role healthy finances would play in getting them there.

About Abbey and Andrea

Abbey Smith serves as the Savory Global Network Coordinator for the Savory Institute. She is also co-owner and operator of the Jefferson Center for Holistic Management with her husband, Spencer. The Jefferson Center is an organic cattle ranch and Savory Global Network Hub in Fort Bidwell, California. Living in the rural community of Surprise Valley, California and being involved in a global organization is a dream come true. Abbey’s happiest moments are on the ranch with her family. She loves running and runs alone, except when in Africa.

Andrea Malmberg has lived her life on the land with livestock and real food in the western United States. She holds a Bachelor of Science in Agriculture and a Master of Science in Natural Resource Sciences from Washington State University. After completing her studies in Zimbabwe and Argentina in 2004, Andrea became an accredited professional in Holistic Management. Seeing the need to bring the tools of human flourishing to rural communities, Andrea received a Masters in Applied Positive Psychology from the University of Pennsylvania.

Earlier this month, Abbey and Andrea hosted a webinar on Holistic Financial Planning. You can access the audio and pdf of this presentation here.

Contact Abbey and Andrea directly to learn more about their work, get in touch and join the conversation (and the work!). They also recommend reading Money Drunk and Money Sober, by Julia Cameron and Mark Bryan. Holistic Financial Planning courses are offered through the Jefferson Center.

About Women in Ranching

Learn more about Women in Ranching here. If you are: not yet part of a Circle but want to be; own or manage a ranch, and able to host 20+ women for 3 days; or interested in becoming a corporate sponsor or learning more about different ways of supporting Women in Ranching, contact Amber Smith: Amber@westernlandowners.org.

Join WLA to stay up to date on the most important news and policy for land stewards.

Become a member for free today and we will send you the news and policy developments critical to the economic and ecological health of working lands.

WLA works on behalf of landowners and practitioners throughout the West. We will never share your contact information with anyone.

©2026 Western Landowners Alliance • PO BOX 27798, Denver, CO 80227 • 505.466.1495

Western Landowners Alliance is a 501 (c)(3) non-profit recognized by the IRS.

Tax ID: 46-1346488