Carbon Crediting

Share

More from this series

Photo: Erika Peterman

Conservation Finance Series—Part Five of Eight

By Jane Rice and Ben Guillon, WRA, Inc., in collaboration with Josh Strauss and Ben Parkhurst, Bluesource LLC.

This blog post is focused on land-based carbon crediting opportunities for forests and grasslands based on the relative maturity of the markets and our assumptions regarding WLA members’ interests.

What is a carbon credit?

A carbon credit is a unit of measurement that represents the removal of one metric ton of carbon dioxide equivalent (tCO2e) from the atmosphere. Carbon credits are typically calculated using protocols developed by internationally recognized standards organizations, such as: The Gold Standard, the American Carbon Registry, the Verified Carbon Standard, the Climate Action Reserve and the California Air Resources Board (California’s air regulatory agency). Carbon credits can be calculated for various different types of projects. Forestry project types include: avoided conversion, afforestation/reforestation, improved forest management and urban forestry, while grassland projects are focused on avoided conversion of grasslands to row crops.

How are carbon credits sold?

Forest carbon credits may be sold in voluntary or compliance markets, while grassland credits can only be sold in the voluntary market, currently. In the voluntary market, private or public entities or individuals choose to purchase credits in order to offset their carbon footprint. Voluntary credit buyers are often motivated by corporate social responsibility objectives or by the expectation of regulation in the future. While the voluntary market is not regulated, standards organizations exist to set project rules and ensure that credits produced are credible, additional (relative to the status quo), and will exist over the long-term. A project must be developed in accordance with standards, validated, and verified on the ground (initially and over time) before credits can be serialized and issued through an established registry. Once issued, credits are sold directly between carbon project owners, credit end-users, and, occasionally, intermediary brokers.

In a compliance market, regulated industries like the power or transportation sectors are required to reduce greenhouse gas emissions and can purchase credits to satisfy part of their emissions reduction obligation. While a variety of compliance mechanisms exist across the U.S. and internationally, the most relevant to western landowners is the California compliance market, which accepts credits from projects located across the country. That said, the percentage of California emissions reductions that may be satisfied using credits is being reduced over time and a higher proportion of credits will be required to come from California-based projects as of 2020. California compliance market credits must be produced using a protocol that is approved by the California Air Resources Board.

How can a landowner develop a carbon project on their property?

Developing a forest carbon project entails conducting an inventory to assess carbon stocks, modeling forest growth and calculating credit yield, creating a forest management plan, undergoing 3rd party verification and submitting all documentation to a registry for approval. The conditions of the property must be evaluated by a third-party verifier before the first credit sale and periodically, over time. Once the registry approves of the project and associated fees have been paid to the registry, the credits can be listed for sale. Most often landowners hire project developers to manage this process and conduct the technical forestry work, modeling, documentation drafting and ultimately to sell the project’s offsets on the project owner’s behalf. Project developers will also prepare financial analyses in advance of project commencement to estimate project costs and revenues.

Grassland carbon projects are simpler to develop than forest projects. They do not require inventories or onsite verification activities, though voluntarily conducting site-based verification work can boost the credit potential of a property. Nonetheless, it is advisable for landowners to work with a project developer to help navigate grassland project protocols and credit registration and sales.

What are the management requirements for a carbon project?

The requirements of the project depend on the standards, protocol and project type. For example, improved forest management projects may require certain harvesting practices or a specific duration in harvest rotations. Grassland projects require less active management compared to forestry projects and are more focused on monitoring and maintenance of site conditions. The length of the project term also depends on the standards and protocol, but generally projects are intended to be long-term. Voluntary projects typically have a shorter project term requirement (e.g. 40 years), whereas compliance projects may require a 100-year or greater project term.

Is a conservation easement required?

Conservation easement requirements depend on the protocol and project type. Typically, grassland projects do require an easement specifying that the property be maintained as grassland, whereas forest carbon projects, with the exception of avoided conversion forest projects, usually do not necessitate the establishment of a conservation easement. However, in the case of a forest carbon project, placing a conservation easement on your property can lower the risk of project failure from the perspective of the registry and increase the project’s credits as a result. If you already have a conservation easement on your property that restricts timber harvests, however, this may disqualify you from participating in the carbon market because the carbon credits would not be considered “additional” relative to the status quo.

Is there a minimum or maximum size for a carbon project?

Developing a forest carbon project is expensive, although project developers will often cover all of the project expenses so that there is no up-front investment needed from the landowner. That being said, properties of 5,000 acres or greater are best positioned to achieve the economy of scale necessary for a project to be profitable. However, there are a few emerging efforts across the country to enable forest carbon projects on smaller privately-owned forests. These include the Carbon Cooperative that is being developed by WRA, Inc. and Sempervirens Fund with support from the Betty and Gordon Moore Foundation in the Santa Cruz Mountains of California to aggregate smaller individually owned properties into larger financially viable projects for forest carbon crediting. Similarly, Forest Carbon Works provides a platform and smartphone-based tools for streamlining forest carbon project development and lowering costs to better enable small landowners to participate in the carbon market.

Grassland projects are not as expensive as forest carbon projects; however, grasslands also generate fewer credits per acre than forests, which means that grassland projects also require parcels to be at least several thousand acres in size, if not tens of thousands of acres.

What are the costs and revenues associated with a carbon project?

The costs and revenues associated with a carbon project are highly dependent on property characteristics (e.g. size of the property, location, conditions/quality and accessibility), the project type and the credit market. If the risks and returns are appropriate, a project developer will often cover the upfront costs of developing a carbon project in exchange for a portion of the credit sale proceeds. In the voluntary market, the average price of domestic forest or grassland credits is about $8, but can range from less than $4 to $15 or more. Projects that are verified by a reputable standard, are located in the U.S. and also provide social or other environmental benefits tend to sell credits at higher prices. The California compliance market credit price has fluctuated around $12 in recent years, although prices are expected to increase to about $15 per credit over the next few years as emission allowances and offset credits become scarcer in response to changing policies. While project-specific factors such as current forest stocking and project location greatly influence the credit generation of improved forest management carbon projects, anywhere between one and ten credits per acre, per year may be generated, on average, over the first ten years of a project. In contrast, grassland projects will often generate between one half and two credits per acre, per year, on average, over the first ten years.

What if there is a fire on the property?

Most standards require an insurance mechanism that covers the loss of credits in the event of a natural disaster, such as a fire. This insurance often comes in the form of “buffer credits,” which are credits set aside by the registries every time there is an issuance of credits. In the case of a fire, landowners are not required to repay the value of these credits (because they will have already provided the insurance), but if the impact of the fire is severe, the landowner’s property may no longer be eligible for generating carbon credits, in which case no additional credit sales would occur.

What if the landowner decides to sell the property, or terminate the project?

If a landowner sells a property that is enrolled in a carbon project, the terms of the project contract remain attached to the land. The value of the land may be impacted if certain development or timber harvest rights are restricted by the specifications of the project. If the new landowner (or previous landowner) decides to terminate the project, they will be responsible for repaying the value of the credits the project has generated and may be subject to a penalty fee as well, depending on the protocol used. Voluntary market protocols tend to be more lenient in this regard.

What are the opportunities to develop a carbon project on grasslands, croplands and wetlands?

Agricultural and ranchlands are increasingly being recognized as an important component of land-based greenhouse gas solutions and associated protocols are gaining traction. There are currently approved methodologies for greenhouse gas reduction crediting on grasslands and rice fields (the Climate Action Reserve), wetland creation, restoration and management (the Verified Carbon Standard) and for adoption of sustainable agricultural land management, soil carbon quantification, and livestock and manure management (Verified Carbon Standard). Most of these methodologies are restricted to the voluntary market and require several thousands of acres to be financially viable. However, projects are being developed under these different methodologies and certain buyers are demonstrating a particular preference for charismatic projects on agricultural and ranchlands.

How do I know if a carbon project is viable on my property?

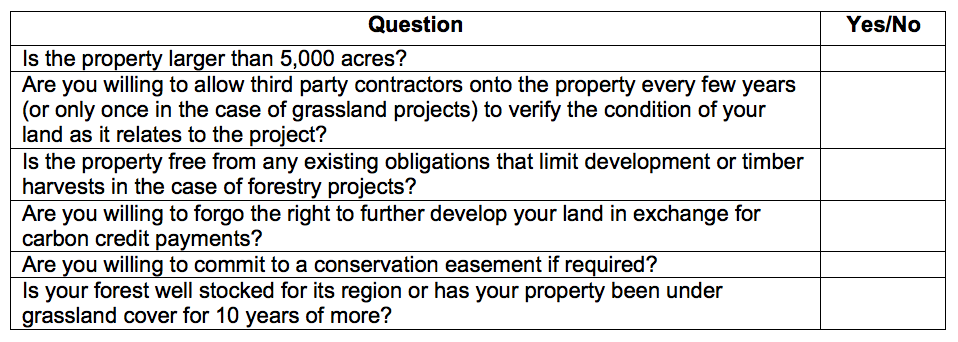

Ultimately, a landowner will need to consult with a project developer to fully understand the carbon sequestration capacity of their land and the financial viability of a project. This type of consultation is generally provided free of charge and the associated analysis can often be carried out in as little as two weeks. However, there are several screening questions that a landowner can answer to decide whether or not to pursue a carbon project. If you answer “yes” to all of these questions, you may be a strong candidate for a carbon project. If you have questions or would like to request additional information, please do not hesitate to reach out to us.

WRA, Inc. (WRA) offers professional consulting services in plant, wildlife, and wetland ecology, water resources engineering, regulatory compliance, mitigation banking, conservation finance, environmental planning, GIS, and landscape architecture. WRA is a national leader in the wetland and species banking industry and recently developed the largest bank in the country. WRA’s conservation finance team is pioneering new monetization approaches across carbon, water, species, and ecotourism markets.

Bluesource, LLC has been a leader in developing and marketing environmental attribute projects in North American markets since 2001, creating some of the first projects for the voluntary and compliance carbon markets. Bluesource was most recently recognized in the 2017 Environmental Finance Market Rankings as the Best Project Developer in all North American markets and the Best Offset Originator in the California market for the third year in a row.

Please keep an eye out for these and other WLA blog posts on our Facebook page and in the WLA newsletter. All blog posts are also archived and easily accessible on our website.

Habitat Leasing Opportunity through USDA’s Grassland Conservation Reserve Program Grows with Important Changes in Western States

By WLA |

New bill would scale up voluntary, locally-led big game conservation on working lands

By Louis Wertz |

Join WLA to stay up to date on the most important news and policy for land stewards.

Become a member for free today and we will send you the news and policy developments critical to the economic and ecological health of working lands.

WLA works on behalf of landowners and practitioners throughout the West. We will never share your contact information with anyone.